Overview

Our objective is to improve our clients’ investment performance by identifying risks and spotting investment opportunities ahead of the market

With our innovative and pragmatic solutions, we offer the right tools for a successful credit and risk management.

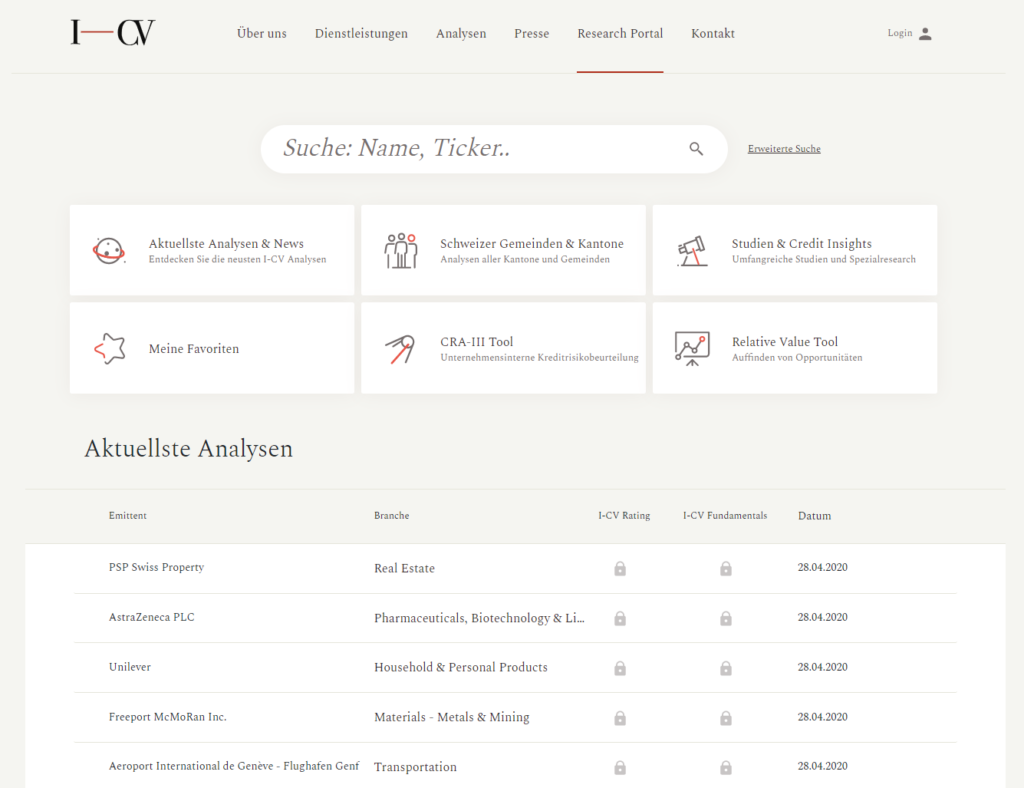

Research Portal

Gateway to our research database

The I-CV Research Portal serves as the central platform to access our analyses, news and studies and as the main gateway to our other tools.

In addition to the search function and an overview of our latest research, you will find additional information on the respective issuer’s page, such as current ratings, the rating history, current and historical reports, a peer overview or relative value information on outstanding bonds.

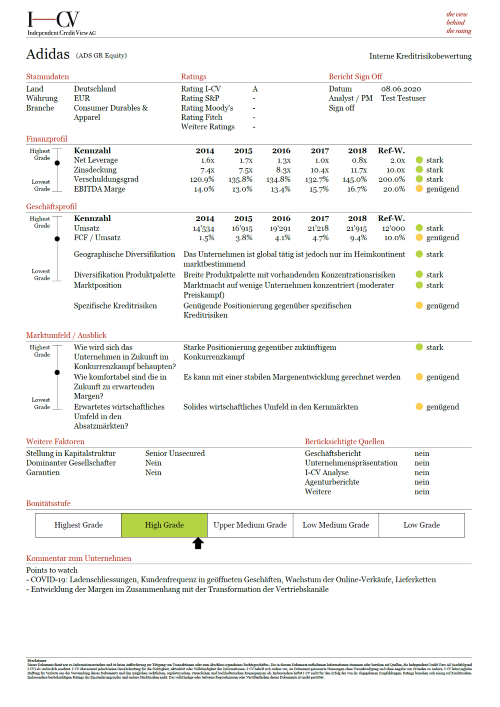

CRA III Tool

Perform your own internal credit risk assessment

The I-CV CRA-III tool offers you a structured and guided process to conduct an internal credit risk assessment. It enables you to implement and fulfil regulatory requirements (CRA III, Solvency II) as well as internal company risk management guidelines to a high professional standard.

The user-friendly online tool integrates I-CV’s credit expertise with industry-specific data and enables you to assess and review the credit risks of issuers quickly and accurately.

- Structured and guided process for the validation of rating classifications considering all relevant rating factors

- Classification into the relevant risk category as defined by the regulator

- Time-efficient plausibility check on ratings to a high standard

- Access to I-CV expertise and specific know-how in credit analysis

- Extensive database of consistent data evaluated by I-CV (differentiation by 28 industries)

- Memory function for your last assessments as well as for previous year’s values

- Documentation of evaluation and export via PDF

- Efficient and cost-effective generation of tailor-made reports for all issuers in your portfolio

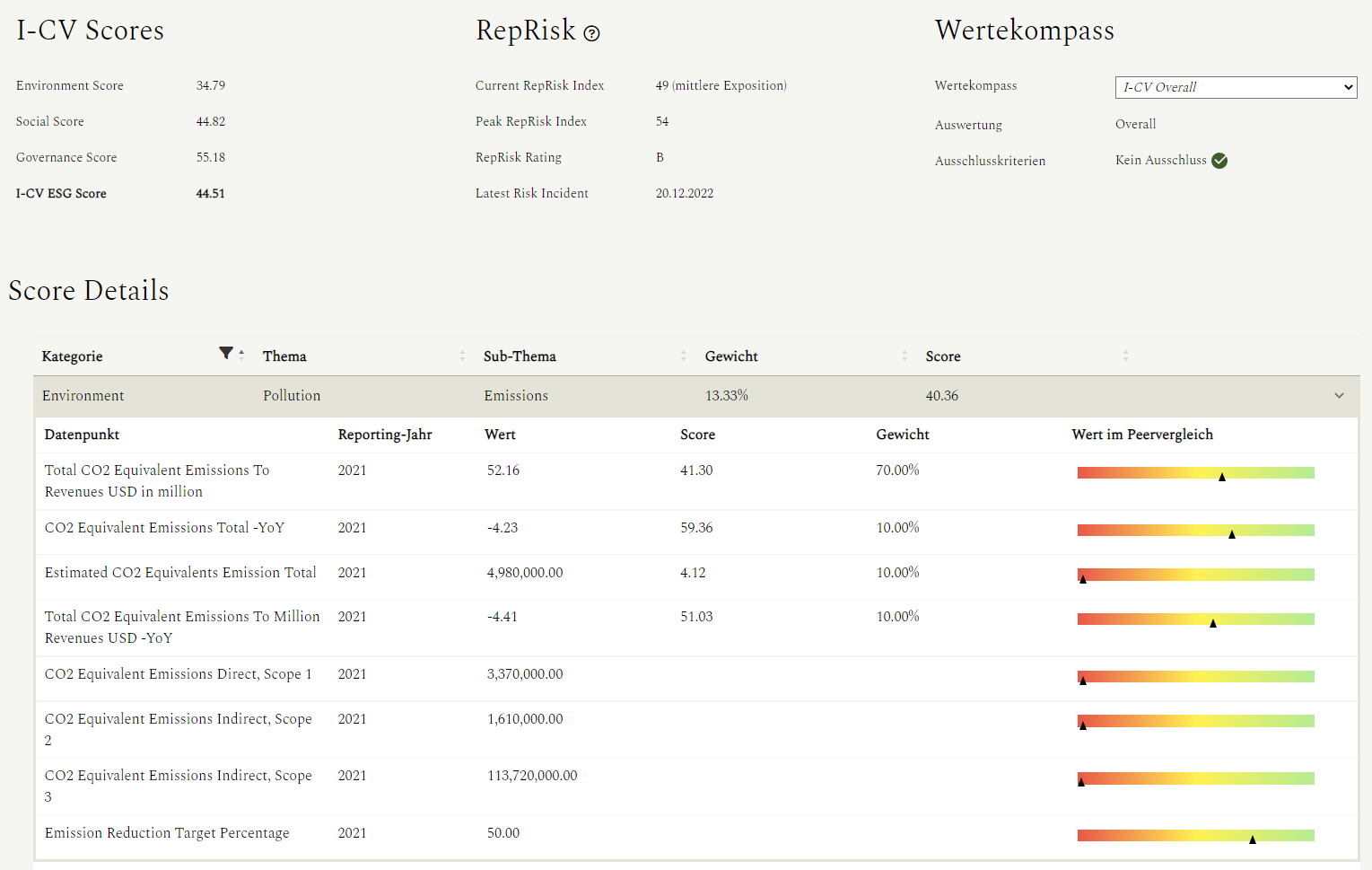

ESG Radar Tool

ESG risk evaluation on the basis of your own value compass

Differentiation through client-specific value compass; The individual ESG strategy (value compass, methodology) is stored in the system and serves as a shared foundation for the evaluation and classification of ESG risks. No adoption of unintended restrictions.

Market-oriented and forward-looking solution; The guided, IT-supported process facilitates risk assessment and enables a 360-degree perspective across all asset classes regarding material ESG risks as well as their developments. The combined expertise of I-CV in collaboration with RepRisk serves investors as a unique reality check (companies’ promises vs. behavior in practice).

Dynamic process without unintentional restrictions; The company specific ESG assessment results in an independent view of investment suitability without relying on fixed thresholds, scores or ratings supplied by third party providers. Portfolio and risk management are in control of investment decisions detached from mainstream views and without succumbing to herd mentality.

Consistent assessment and documentation; All parties involved in the investment process share the same understanding and approach when assessing. Consistent documentation of investment decisions and comprehensive portfolio evaluations ensure compliance with internal and regulatory requirements.

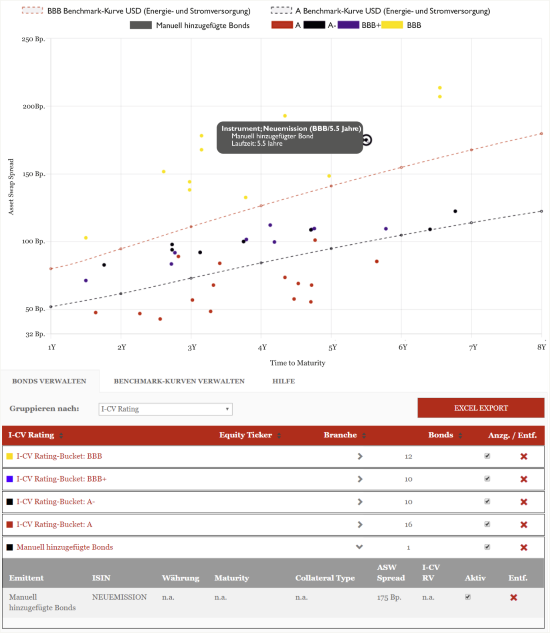

Relative Value Tool

Assessment of credit risk premiums

The I-CV Relative Value Tool supports our clients in active portfolio management and provides valuable assistance in assessing adequacy of risk premia and in identifying attractive bonds as investment opportunities.

- Access to over 7’000 credit instruments

- Comparison to I-CV rating benchmark curves

- Support along the investment process (identification of market opportunities / signal for risk reduction)

- Continuity and independence

- Time savings through simple and self-explanatory navigation

- Additional features such as simulation of specific bond parameters or Excel export of personalised selections

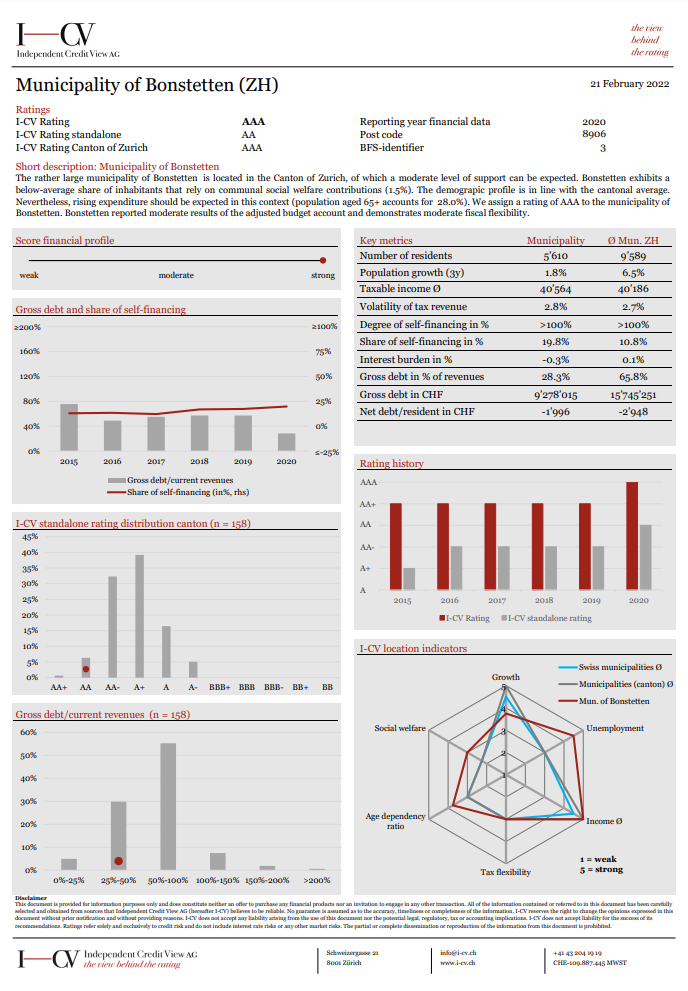

Municipality Modell

Swiss Subsovereign Rating Model

For the selection and monitoring of loans to Swiss municipalities and public-sector entities, we have developed a sophisticated rating approach that combines traditional credit assessment tools with an application-based algorithm. Our reports are available in English, German and French.

The four-phase model is based on the following factors:

Analysis of credit metrics: Quantitative profile of each municipality based on fiscal date such as debt ratio, interest charges and self-financing

Location data: Identification of factors which can be decisive for the future rating development of a municipality

Stand-alone Rating: Intrinsic credit rating based on overall score from credit metrics and location data

Supporting factors: Assessment of legal framework and support factors to determine ability and willingness to provide timely support