Overview

True to our claim “the view behind the rating”, we analyze, evaluate and monitor the credit quality of national and international capital market issuers, private placements and loans.

Our insights are translated into independent credit ratings and value oriented recommendations that improve investment performance.

Our modular services concept allows us to provide tailor-made solutions to a broad spectrum of client needs in the area of credit analysis and credit risk management.

Ratings & Credit Research

I-CV’s ratings, research studies and presentations, offer investors an insightful, fresh and unbiased appraisal of current trends and developments in the credit markets. Based on our work our clients are able to detect early warning signals about forthcoming rating actions and adapt their investment strategies accordingly, offering a real competitive advantage.

We work with a robust analysis process that results in an I-CV rating, a fundamental outlook as well as a relative value-based recommendation. The I-CV rating is a well established source for investors in search of a reliable early warning indicator or an unbiased second opinion to substantiate their investment decisions.

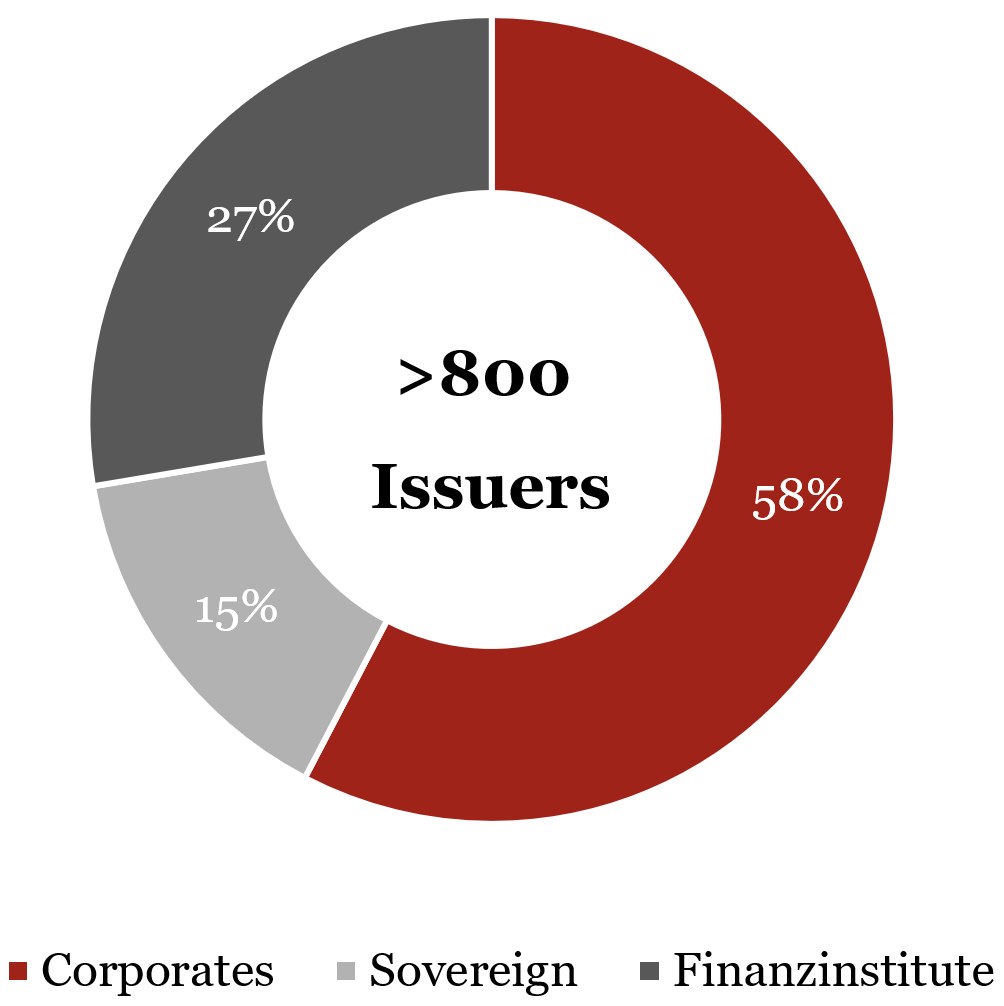

The I-CV research universe is driven by the portfolio positions and investment preferences of our clients. Our current coverage includes over 800 issuers and consists of virtually all issuers in the CHF capital market (investment grade and non-investment grade) as well as the most traded investment grade issuers in European markets and the US. In addition, we also cover less well-known issuers of promissory notes.

Private Debt Analysis

On behalf of our clients, we also prepare individual analyses to assess the credit risks of private debt investments. Our long-lasting experience in the creation of models, stress tests and scenario analyses support our clients with a second opinion when evaluating investments in the area of:

- Structured credit and real-estate portfolios

- Financing of real-estate development projects

- Infrastructure Project Finance

- Corporate financing

- ABS / CLO Mezzanine transactions etc.

We also support our clients in monitoring private debt funds. A regular review of the supplied data is quantitatively screened and evaluated with our proprietary software and summarised in a report. On request, possible red-flag cases are then additionally assessed in an in-depth analysis.

Portfolio Monitoring

We analyse and monitor the credit quality of our client’s portfolios on a permanent basis. In case of suspected rating shifts (ratings/fundamentals) our clients are notified promptly.

We provide periodic reporting of all client positions with our ratings, fundamentals and relative value recommendations and offer an electronic interface (API).

We conduct periodic on-site reviews with our clients where we provide a review and outlook on the dynamics of credit markets, perform an in-depth assessment of all portfolio positions and highlight at risk positions as well as market opportunities.

Risk Check-up

I-CV deploys a structured approach to conduct a comprehensive diagnosis on the client’s bond portfolio with the objective of identifying hidden risks early on and highlighting value opportunities. This is rounded off by a presentation of the results at the client’s premises, including a review and outlook on the credit markets.

The first months of the global Covid-19 pandemic have provided insight into the vulnerability of supposedly safe debtors. With low visibility and difficult business conditions, the situation remains tense for many companies. With comprehensive stress tests and a thorough analysis of the liquidity situation, we are continuously scanning our universe to identify potential winners and losers.

Advisory

We provide proactive investment advice within the specific investment guidelines of our clients with the objective to identify opportunities and to take advantage of market inefficiencies.

With our “Research Hotline” we offer direct access to our analysts in order to provide timely response on secondary or primary market offers.

Counterparty risk monitoring

We provide models and tools to ensure the classification and monitoring of counterparty risks as part of the ongoing internal risk management process.

We can rely on our in-depth industry knowledge and comprehensive coverage.

Companies which we support in this respect come from the following sectors, for example:

- Utility and energy companies

- Banks

- Insurances etc.